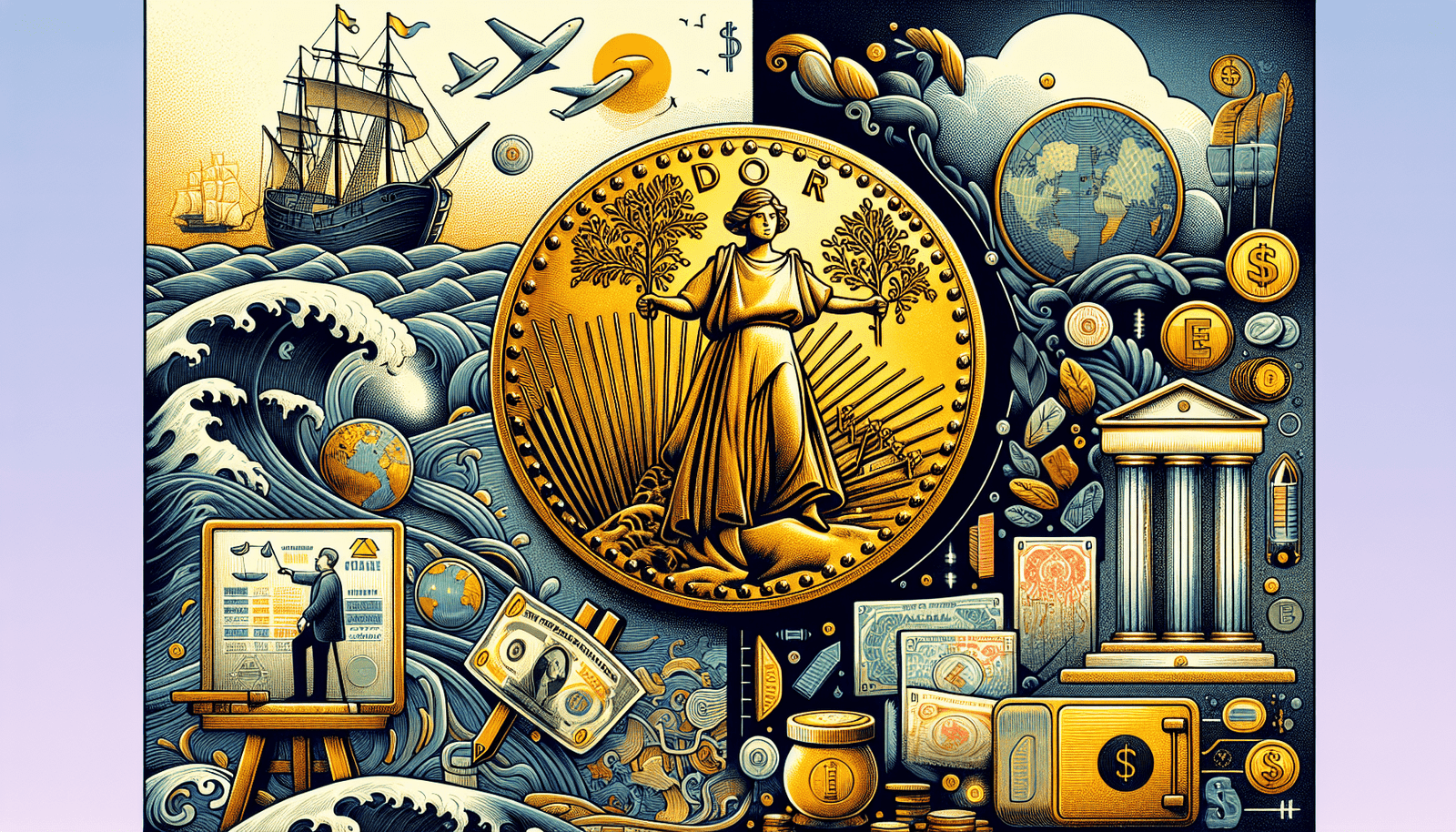

Welcome to a fascinating historical analysis comparing the Gold Standard and Fiat Currency. In this article, you will explore the differences between these two monetary systems, understanding the impact they have had on economies throughout history. From the stability of a currency backed by gold to the flexibility of a fiat currency, you will gain insight into the evolution of monetary policies and their implications for global economies. Get ready to deepen your understanding of the financial world and the complexities of monetary systems as we delve into this informative comparison.

Historical Analysis: Gold Standard Vs. Fiat Currency

Have you ever wondered about the difference between the Gold Standard and Fiat Currency? Let’s take a deep dive into the history and dynamics of these two monetary systems to gain a better understanding of how they have shaped economies throughout the ages.

The Gold Standard

The Gold Standard is a monetary system where the value of a country’s currency is directly linked to a specific amount of gold. Under this system, the government or central bank holds a reserve of gold, and the amount of currency in circulation is supposed to be backed by the equivalent amount of gold.

In the 19th and early 20th centuries, many countries, including the United States, adopted the Gold Standard as the basis for their currency systems. This system provided stability and predictability to the economy as the value of money was tied to a tangible and precious asset.

### Benefits of the Gold Standard

One of the main benefits of the Gold Standard is its ability to limit inflation. Since the amount of currency in circulation is directly tied to the amount of gold reserves, governments cannot print money indiscriminately, leading to a more stable economic environment.

Another advantage of the Gold Standard is its role in fostering international trade. Because currencies were pegged to gold, foreign exchange rates were relatively stable, making it easier for businesses to engage in cross-border transactions without worrying about volatile currency fluctuations.

### Drawbacks of the Gold Standard

However, the Gold Standard also had its drawbacks. One of the major limitations of this system was its inability to adjust to changes in the economy. For example, during times of economic crisis or war, countries found it difficult to stimulate their economies by increasing the money supply, as they were bound by the fixed amount of gold reserves.

Furthermore, the strict adherence to the Gold Standard constrained the flexibility of monetary policy, making it challenging for governments to respond effectively to economic challenges. This lack of flexibility ultimately led to the downfall of the Gold Standard in the 20th century.

Fiat Currency

In contrast to the Gold Standard, Fiat Currency is a monetary system where the value of money is not backed by any physical commodity like gold or silver. Instead, the value of Fiat Currency is derived from the trust and confidence of the people who use it.

Almost all countries in the world today operate on a Fiat Currency system, where the government or central bank has the authority to issue and regulate the supply of money based on economic conditions and policy objectives.

### Benefits of Fiat Currency

One of the main advantages of Fiat Currency is its flexibility. Without being tied to a specific commodity, governments have the freedom to adjust the money supply according to the needs of the economy. This flexibility allows policymakers to respond quickly to changing economic conditions and implement monetary policies to stimulate growth or curb inflation.

Additionally, Fiat Currency provides stability in times of crisis. During economic downturns, central banks can print more money to inject liquidity into the financial system, helping to prevent deflation and stimulate economic activity.

### Drawbacks of Fiat Currency

However, Fiat Currency is not without its criticisms. One of the main concerns surrounding Fiat Currency is the potential for devaluation. Since the value of Fiat Currency is not tied to any physical asset, governments can print money excessively, leading to inflation and a decrease in purchasing power.

Another drawback of Fiat Currency is the lack of a tangible anchor. Without a fixed standard like gold to back the currency, Fiat Currency relies heavily on trust and confidence. If people lose faith in the currency or the government’s ability to manage it, the value of Fiat Currency can plummet, leading to economic instability.

Historical Comparison

When comparing the Gold Standard and Fiat Currency, it’s essential to consider their historical performance and impact on economies. While the Gold Standard provided stability and predictability, its rigid structure limited the ability of governments to respond to economic crises and promote growth.

On the other hand, Fiat Currency offers flexibility and adaptability, allowing central banks to implement monetary policies to support economic stability and growth. However, the lack of a tangible standard and the potential for devaluation remain significant concerns with Fiat Currency.

### Case Studies

Let’s take a look at a couple of case studies to better understand how the Gold Standard and Fiat Currency have fared in practice:

Gold Standard: Great Depression (1929-1939)

During the Great Depression, countries adhering to the Gold Standard faced severe economic challenges. The fixed exchange rates and limited ability to increase the money supply exacerbated the effects of the global economic downturn.

Fiat Currency: Global Financial Crisis (2007-2008)

In contrast, during the Global Financial Crisis, central banks around the world used Fiat Currency to implement unconventional monetary policies, such as quantitative easing, to stabilize financial markets and prevent a complete collapse of the global economy.

These case studies highlight the strengths and weaknesses of both monetary systems in responding to economic crises and implications for long-term economic stability.

Conclusion

In conclusion, the debate between the Gold Standard and Fiat Currency continues to shape monetary policy and economic theory. While the Gold Standard provided stability and discipline, it lacked the flexibility and adaptability needed to navigate modern economic challenges.

On the other hand, Fiat Currency offers policymakers the tools to address economic crises effectively and stimulate growth. However, concerns about inflation, devaluation, and economic instability persist with this system.

Whether one system is superior to the other remains a subject of ongoing discussion and analysis. As economies evolve and global financial systems become more interconnected, finding the right balance between stability and flexibility will be crucial in shaping the future of monetary policy.

So, what do you think – Gold Standard or Fiat Currency? Share your thoughts and join the conversation on the future of monetary systems.