Did you know that adding precious metals to your retirement portfolio could be a smart move? Many financial experts believe that diversifying your investments with assets like gold, silver, and platinum can provide stability and protection against market volatility. In this article, we will explore the benefits of incorporating precious metals into your retirement plan and how they can help safeguard your future financial security. So, if you’re looking to make your retirement nest egg more resilient, keep reading to see why adding a touch of sparkle to your portfolio might be just what you need.

Why diversify retirement portfolios?

Benefits of diversification

Diversification is a key strategy when it comes to building a retirement portfolio. By spreading your investments across different asset classes, you can potentially reduce risk and increase your chances of achieving long-term financial goals.

One of the main benefits of diversification is the potential for higher returns. By investing in a variety of assets, you can tap into different markets and sectors, which can lead to increased growth potential. This can be especially important as you approach retirement, as you may need to rely on your investments to generate income.

Another benefit of diversification is the potential to reduce risk. Different asset classes tend to perform differently under varying economic conditions. By spreading your investments across stocks, bonds, real estate, and other assets, you can potentially reduce the impact of any one investment on your overall portfolio. This can help protect you from significant losses in the event of a market downturn.

Risks of an undiversified portfolio

On the flip side, an undiversified portfolio can put your retirement savings at risk. If you have all your eggs in one basket, so to speak, you are exposed to the performance and volatility of a single asset or market. If that asset or market experiences a downturn, your entire portfolio can suffer.

For example, let’s say you have invested only in tech stocks. If the tech sector experiences a significant decline, your portfolio could take a big hit. This could jeopardize your retirement plans and leave you with limited options.

It’s important to remember that even historically strong sectors or assets can go through periods of underperformance. Diversification can help mitigate this risk and give you a more balanced and resilient portfolio.

Understanding retirement portfolio diversification

Retirement portfolio diversification involves spreading investments across different asset classes and investment vehicles to help reduce risk and optimize returns. The goal is to create a well-rounded portfolio that can weather market fluctuations and provide a steady income stream in retirement.

When diversifying your portfolio, it’s important to consider your risk tolerance, investment goals, and time horizon. It’s also crucial to understand the correlation between different assets. Correlation refers to how closely two assets move in relation to each other. Ideally, you want assets that are not highly correlated, as this can provide greater diversification benefits.

By diversifying your retirement portfolio, you can potentially achieve a more stable and secure financial future.

What are precious metals?

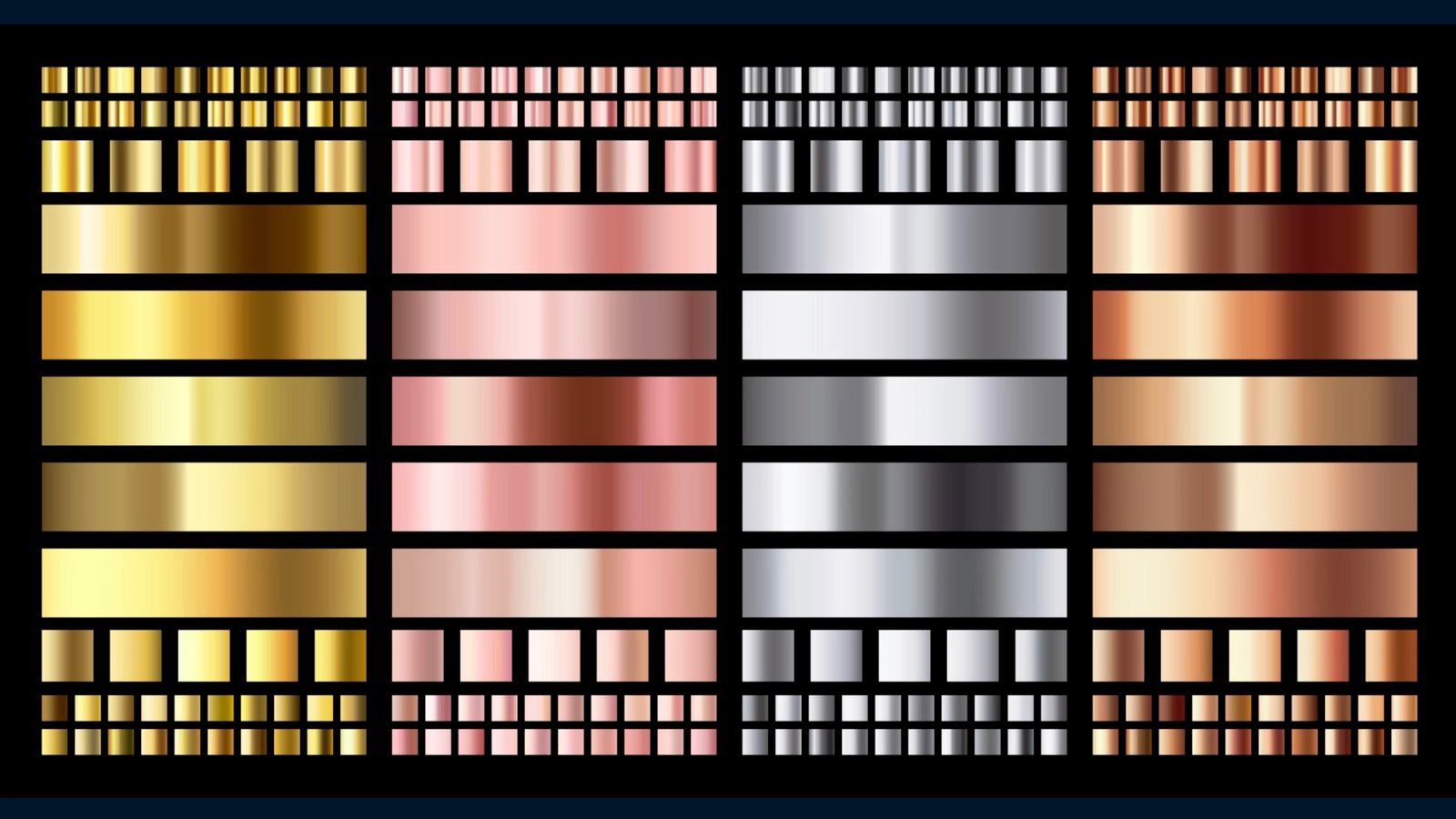

Definition of precious metals

Precious metals are naturally occurring metallic elements that have high economic value. They are considered rare and are often used in various industries, including jewelry, electronics, and currencies.

The most widely recognized precious metals are gold, silver, platinum, and palladium. These metals have been valued throughout history for their beauty, rarity, and store of wealth properties.

Popular types of precious metals

Gold is perhaps the most iconic precious metal. It has long been used as a form of currency and a store of value. Silver is another popular precious metal, valued for its industrial and investment applications. Platinum and palladium are less well-known but are also highly valuable and widely used in industries such as automotive and jewelry.

Investors can choose to invest in physical precious metals by buying bullion bars or coins. Alternatively, there are also investment vehicles available, such as exchange-traded funds (ETFs) and mining stocks.

Historical performance of precious metals

Precious metals have a long history of maintaining value and even appreciating over time. Gold, in particular, has been seen as a safe haven during times of economic uncertainty or inflation. During periods of market turmoil, investors often flock to gold as a store of value, which can drive up its price.

Silver and other precious metals have also experienced significant price increases during certain periods, driven by factors such as increased industrial demand or supply constraints.

While past performance is not indicative of future results, the historical performance of precious metals suggests that they can be a valuable addition to a diversified retirement portfolio.

Importance of precious metals in retirement portfolios

Preserving wealth and hedging against inflation

One of the key reasons to include precious metals in a retirement portfolio is their ability to preserve wealth. Unlike paper-based assets, such as stocks or bonds, precious metals have inherent value that is not dependent on any government or financial institution.

During times of inflation or economic uncertainty, the value of paper currency can erode. Precious metals, on the other hand, tend to maintain their value or even appreciate, making them a viable hedge against inflation.

Gold, in particular, has long been seen as a safe haven asset during times of economic crisis. Its value has often increased when other assets, such as stocks, decline in value. By including gold and other precious metals in your retirement portfolio, you can potentially protect your wealth and mitigate the impact of inflation.

Protection against market volatility

Precious metals can also provide a hedge against market volatility. The value of stocks and bonds can fluctuate greatly in response to changing economic conditions or investor sentiment. During periods of market turbulence, precious metals have historically shown resilience and stability.

By including precious metals in your retirement portfolio, you can potentially reduce the impact of market downturns on your overall wealth. This can help provide peace of mind and financial stability, particularly during retirement when you may rely on your investments for income.

Diversification benefits of precious metals

One of the key advantages of adding precious metals to your retirement portfolio is the diversification benefits they offer. Precious metals have a low correlation to traditional assets like stocks and bonds, meaning their prices often move independently of these asset classes.

This low correlation can provide valuable diversification benefits. During periods of stock market declines, for example, the value of precious metals may be less affected or could even rise. This can help offset losses from other parts of your portfolio and potentially enhance overall portfolio performance.

Therefore, by diversifying your retirement portfolio with precious metals, you can potentially increase your chances of achieving your long-term financial goals and protect against market volatility.

How to invest in precious metals

Physical ownership of precious metals

One way to invest in precious metals is by owning physical gold, silver, or other metals in the form of bars or coins. This provides direct ownership of the metal and allows you to have physical possession of the asset.

Many investors choose to buy gold or silver bullion bars or coins from reputable dealers. It’s important to ensure the authenticity and purity of the metals when purchasing physical assets. Storing and securing the precious metals is also a consideration, as they need to be kept in a safe and secure location.

Buying shares of precious metal ETFs

Another option for investing in precious metals is through exchange-traded funds, or ETFs. Precious metal ETFs are investment funds that hold physical gold, silver, or other precious metals on behalf of investors.

By buying shares of a precious metal ETF, you indirectly have exposure to the price movements of the underlying metal. This provides a convenient and cost-effective way to invest in precious metals without the need for physical storage or ownership.

Investing in precious metal mining stocks

Investors can also gain exposure to the precious metals market by investing in mining stocks. Precious metal mining companies extract and produce gold, silver, and other metals from the earth.

Investing in mining stocks can provide a way to benefit from the potential price appreciation of precious metals and the profitability of mining operations. However, it’s important to note that mining stocks can be subject to additional risks and volatility compared to direct ownership of physical metals or ETFs.

Considerations before adding precious metals to a retirement portfolio

Risk tolerance and investment goals

Before adding precious metals to your retirement portfolio, it’s important to assess your risk tolerance and investment goals. Precious metals, like any investment, come with their own set of risks and potential rewards.

Precious metals can be subject to price volatility and fluctuations in demand. Therefore, if you have a low tolerance for risk or prefer more stable and predictable investments, a higher allocation to precious metals may not be suitable for you.

It’s also important to consider your investment goals. Precious metals can serve as a hedge against inflation and market volatility, but they may not provide the same level of income generation as other assets. If your primary goal is to generate income in retirement, you may need to explore other investment options.

Understanding storage and insurance costs

When investing in physical precious metals, it’s important to consider the costs associated with storing and insuring the assets. Physical gold bars or coins need to be securely stored, which may require renting a safe deposit box or investing in a secure storage facility.

Insurance is also a crucial consideration when holding physical metals. While precious metals have intrinsic value, they can still be susceptible to theft or loss. Therefore, it’s important to ensure that your investments are adequately insured to protect your wealth.

Tax implications of investing in precious metals

Another consideration before adding precious metals to your retirement portfolio is the tax implications. The taxation of precious metals can vary depending on factors such as the form of the investment (physical or ETF), the holding period, and the country of residence.

In some cases, gains from the sale of physical metals may be subject to capital gains tax. It’s important to consult with a tax professional or financial advisor to understand the tax implications specific to your situation.

Factors affecting the value of precious metals

Supply and demand dynamics

One of the primary factors influencing the value of precious metals is the supply and demand dynamics. The availability of precious metals, as determined by mining production and recycling, can impact their prices.

Changes in demand from various industries, such as jewelry, electronics, and investment, can also affect the value of precious metals. For example, increased demand for silver in solar panel production can drive up its price.

Understanding the supply and demand dynamics can help investors make informed decisions when investing in precious metals.

Geopolitical and economic factors

Geopolitical and economic factors can also influence the value of precious metals. Political instability, trade disputes, and economic policies can create uncertainty in the markets, driving investors towards safe haven assets like gold.

Changes in interest rates, inflation expectations, and currency fluctuations can also impact precious metal prices. For example, if interest rates rise, the opportunity cost of holding non-yielding precious metals may increase, potentially leading to a decrease in demand.

Keeping abreast of geopolitical and economic developments can help investors navigate the precious metals market effectively.

Potential drawbacks of investing in precious metals

Lack of income from precious metals

One potential drawback of investing in precious metals is the lack of income generated by these assets. Unlike stocks or bonds, precious metals do not typically provide regular income in the form of dividends or coupon payments.

Investors who rely on income generated from their investments may need to consider alternative assets or investment strategies to meet their income needs.

Potential for price volatility

As with any investment, precious metals are subject to price volatility. The prices of precious metals can fluctuate based on various factors, including economic conditions, market sentiment, and supply and demand dynamics.

Price volatility can make it challenging to time the market and generate consistent returns. Investors who are concerned about volatility may need to have a longer-term investment horizon and a higher risk tolerance.

Challenges of timing the market

Timing the market is a challenging task even for experienced investors. Precious metals, like any other asset class, can go through periods of highs and lows. Attempting to time the market and buy or sell precious metals based on short-term price movements can be risky.

Instead of trying to time the market, it’s often recommended to take a long-term approach when investing in precious metals. By focusing on the underlying fundamentals and the potential for long-term value, investors can reduce the impact of short-term market fluctuations.

Comparison with other retirement portfolio assets

Stocks and bonds

Stocks and bonds are traditional assets that are commonly included in retirement portfolios. Stocks represent ownership in a company and offer the potential for capital appreciation and dividend income. Bonds are debt securities that provide fixed income in the form of interest payments.

Compared to precious metals, stocks and bonds can offer regular income and the potential for growth. However, they are also subject to market volatility and can be affected by economic conditions and corporate performance.

Including a mix of stocks, bonds, and precious metals in a retirement portfolio can provide diversification and balance, considering the different risk and return characteristics of each asset class.

Real estate

Real estate is another asset class commonly included in retirement portfolios. Investment properties or real estate investment trusts (REITs) can offer regular income in the form of rental payments, as well as potential capital appreciation over time.

Real estate investments can provide diversification benefits and act as a hedge against inflation. However, they can also be illiquid and require ongoing maintenance and management.

Including real estate alongside precious metals in a retirement portfolio can provide exposure to the potential income and growth opportunities offered by the property market.

Cryptocurrencies

Cryptocurrencies, such as Bitcoin and Ethereum, have gained popularity in recent years. These digital assets offer the potential for high returns but are also highly volatile and speculative.

Compared to precious metals, cryptocurrencies are a relatively new asset class and come with their own unique risks and challenges. They are not tied to any physical or tangible asset and are subject to regulatory developments and technological advancements.

Investing in cryptocurrencies can be seen as a higher-risk, higher-reward proposition compared to precious metals. Including a small allocation of cryptocurrencies in a retirement portfolio may appeal to investors with a high risk tolerance and a long-term investment horizon.

Diversification strategies incorporating precious metals

Percentage allocation to precious metals

The ideal percentage allocation to precious metals in a retirement portfolio may vary based on individual preferences and goals. Some financial advisors suggest allocating around 5-10% of the portfolio to precious metals, while others recommend higher or lower allocations depending on the investor’s risk tolerance and market outlook.

The key principle is to strike a balance between diversification and risk management. By allocating a portion of the portfolio to precious metals, investors can potentially benefit from the diversification benefits and potential upside of these assets while still maintaining exposure to other asset classes.

Rebalancing and reviewing the portfolio

Regularly reviewing and rebalancing a retirement portfolio is essential to ensure it remains aligned with your investment goals and risk tolerance. Rebalancing involves adjusting the portfolio’s asset allocation to maintain the desired percentage allocation to different asset classes.

As the value of different assets fluctuates, the portfolio’s weighting can shift. Rebalancing allows you to sell investments that have performed well and increase exposure to those that have underperformed.

Including precious metals in your retirement portfolio requires periodic review and adjustment to ensure the allocation remains appropriate and in line with your risk tolerance.

Combining precious metals with other alternative assets

In addition to precious metals, there are other alternative assets that can be considered for diversification in a retirement portfolio. These can include real estate investment trusts (REITs), commodities, hedge funds, or private equity.

By combining different alternative assets, investors can potentially further enhance diversification and reduce risk. Each asset class has its unique risk and return characteristics, and together they can provide a more comprehensive and resilient portfolio.

The specific combination of assets will depend on factors such as risk tolerance, investment goals, and market outlook. Working with a financial advisor can help you determine the most suitable combination for your retirement portfolio.

Case studies of successful retirement portfolios with precious metals

Portfolio examples of diversification using precious metals

There are numerous examples of successful retirement portfolios that have incorporated precious metals as part of their diversification strategy. For example, a portfolio could include a mix of stocks, bonds, real estate, and precious metals, allocated according to the investor’s risk tolerance and investment goals.

By including precious metals as a small portion of the overall portfolio, investors have the potential to benefit from the diversification benefits offered by these assets while still maintaining exposure to other asset classes.

Performance analysis of precious metals in different economic conditions

Analyzing the performance of precious metals in different economic conditions can provide valuable insights into their potential role in a retirement portfolio.

During periods of market turmoil or economic uncertainty, such as the 2008 financial crisis, precious metals have historically performed well. Gold, in particular, has often seen increased demand as investors seek safe haven assets.

Performance during periods of economic growth and stability can vary for precious metals. Factors such as interest rates, inflation expectations, and supply and demand dynamics can influence their prices. However, over the long term, precious metals have generally shown the ability to preserve wealth and provide a potential hedge against inflation.

Expert advice and testimonials

Many financial experts and retirement planning professionals recommend including precious metals in a diversified retirement portfolio. Their advice is often based on historical data, market trends, and analysis of long-term investment performance.

Testimonials from investors who have successfully incorporated precious metals into their retirement portfolios can also provide valuable insights. These testimonials can highlight the benefits of diversification, the role of precious metals in preserving wealth, and the potential for long-term growth.

When considering adding precious metals to your retirement portfolio, it’s essential to consult with a financial advisor or retirement planning expert who can provide personalized advice based on your individual circumstances and goals. They can help you assess the appropriate allocation, review the tax implications, and guide you on timing and execution.

In conclusion, diversifying your retirement portfolio with precious metals can provide multiple benefits. These assets offer potential wealth preservation, protection against inflation and market volatility, and diversification benefits. Whether you choose to invest in physical metals, ETFs, or mining stocks, it’s essential to carefully consider your risk tolerance, investment goals, and market outlook. By incorporating precious metals alongside other assets in a well-rounded retirement portfolio, you can increase your chances of achieving long-term financial success and a secure retirement.